The Great American Migration: Why 2025 Could Be Self-Storage's Biggest Year Yet

Something unprecedented is happening across America. A massive wave of relocations is building, and it's about to reshape the self-storage industry in ways we haven't seen in decades.

According to Storable's latest research, 37% of Americans are planning or considering a move within the next 6-12 months—a staggering 48% increase from just 25% reported in March 2024. When you factor in the additional 23% who responded "Maybe" to moving plans, we're looking at potentially 60% of Americans considering relocation.

For self-storage operators, this isn't just interesting data—it's a roadmap to unprecedented opportunity.

The Numbers Don't Lie: A Storage Boom is Coming

Let's break down what this migration surge means for our industry:

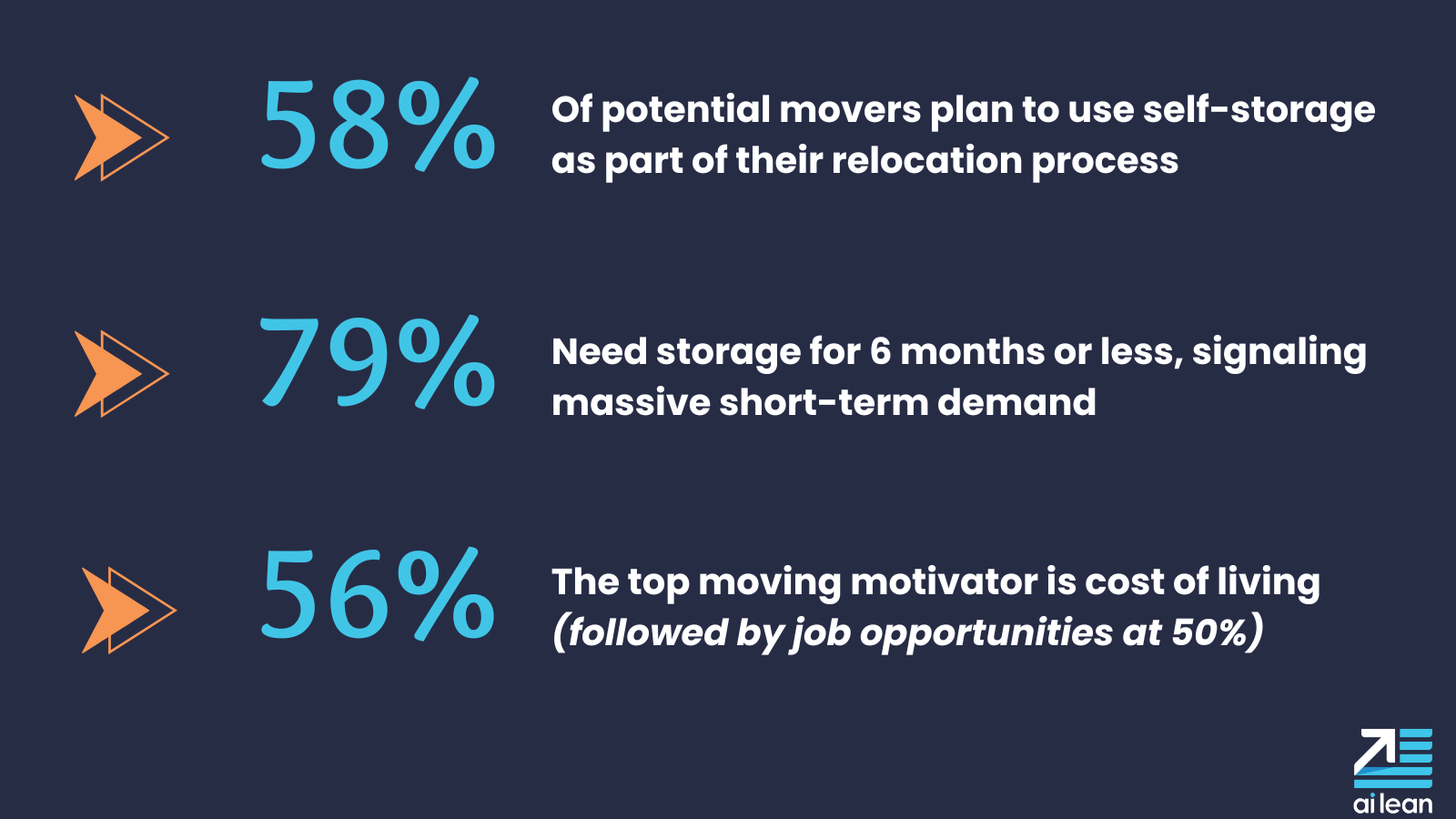

58% of potential movers plan to use self-storage as part of their relocation process

79% need storage for 6 months or less, signaling massive short-term demand

The top moving motivator is cost of living (56%), followed by job opportunities (50%)

To put this in perspective: if even half of these potential movers follow through and use storage, we're looking at roughly 107 million Americans potentially needing storage services in the next year. That's more than the entire populations of California, Texas, and Florida combined.

What's Driving the Great Migration?

The data reveals clear patterns in why Americans are on the move:

Economic Pressures Lead the Pack

Cost of living concerns drive 56% of potential moves

Better job markets attract 50% of movers

Housing changes motivate 40%

Interest Rates Are the X-Factor Perhaps most telling: 13% of respondents said their move was conditional on interest rates lowering. Among younger adults (18-34), this jumps to 18%. With the Federal Reserve signaling potential rate cuts, we could see this pent-up demand unleash rapidly.

As one industry analyst noted, "The Fed's recent signals about rate reductions may be the catalyst that transforms 'maybe' movers into definitive relocators."

Where Everyone's Headed: Regional Goldmines

The migration isn't random—it's following clear geographic patterns:

The South leads destination preferences at 40% of potential movers

Northeast follows at 23% (signaling a potential rebound after recent population declines)

West and Midwest trail at 12% and 21% respectively

For storage operators, this creates distinct strategic opportunities. Southern markets should prepare for unprecedented demand, while operators in source regions need retention strategies as customers relocate.

The Short-Term Storage Revolution

Here's where it gets really interesting for our industry: 79% of respondents need storage for 6 months or less. This represents a fundamental shift toward short-term, flexible storage solutions.

Traditional storage models built around long-term tenants may need to evolve. Operators who can offer:

Month-to-month flexibility without penalties

Easy online booking for remote customers

Streamlined move-in/move-out processes

Competitive short-term rates

...will capture the lion's share of this migration-driven demand.

Technology: The Migration Enabler

With potential movers spread across state lines, technology becomes crucial. The data shows why:

Cross-country movers need remote booking capabilities

Virtual unit viewing helps decision-making from afar

Smart access systems eliminate key exchanges for distant customers

Mobile management allows oversight during complex relocations

Consider this scenario: A family in expensive California decides to relocate to affordable Texas for cost of living reasons. They need storage both in their origin city (while preparing to move) and destination city (while settling in). The operator who can provide seamless, tech-enabled service across both locations wins their business.

Preparing for the Wave: Strategic Recommendations

1. Invest in Technology Infrastructure With 66% of customers considering technology important, robust online booking and management systems aren't optional—they're essential for capturing migration demand.

2. Develop Flexible Rental Models Traditional annual leases won't work for the 79% needing short-term storage. Consider:

Promotional rates for 3-6 month commitments

Easy extension options

No-penalty early termination policies

3. Target High-Migration Corridors Focus marketing efforts on:

California to Texas/Arizona/Nevada routes

New York to Florida/North Carolina corridors

Illinois to Southern state destinations

4. Price Strategically Remember: 83% of customers cite price as the key selection factor (up from 69% earlier in 2024). With relocation expenses mounting, storage becomes a cost-cutting target. Balance competitive pricing with value-added services.

5. Enhance Security Messaging For customers moving valuable belongings across long distances, security becomes paramount. Prominent security features can differentiate your facility, especially among older demographics where 71% consider security crucial.

The Bottom Line: Act Now or Miss Out

This migration surge isn't theoretical—it's happening now. The 48% increase in moving intentions over just five months suggests the trend is accelerating, not stabilizing.

Storage operators who recognize this moment and adapt quickly will capture unprecedented growth. Those who wait may find themselves watching opportunity pass by as competitors seize the migration advantage.

The data is clear: America is on the move, and they're bringing their storage needs with them.

The question isn't whether this will impact your business—it's whether you'll be ready to capitalize on it.

References

Storable Self-Storage Outlook Guide 2025 - Primary data source for migration statistics and consumer behavior trends

AI Lean Case Study: Storage Star - For automation impact examples and customer testimonials

Self-Storage Industry Statistics (Storeganise, 2024) - Supporting industry context and market size data

Cushman & Wakefield Self Storage Market Trends Report H1 2024 - Regional market performance data

Federal Reserve Economic Data - Interest rate trends and economic indicators

Related Resources

How to Get Sued in 4 Easy Steps: A Self-Storage Operator's Guide to Manual Lien Compliance - Technology solutions for compliance

New Lien Law Pitfalls: How a 9pm Notice Could Cost You $1000 - State-specific compliance challenges

Ai Lean as a Strategic Partner in Growth: Storage Star Case Study - Automation success story

Automating Lien Compliance: The Secret Weapon for Self-Storage Profitability - Operational efficiency strategies

Note: Statistical projections and scenario examples are based on survey data extrapolations and industry analysis. Individual market results may vary based on local economic conditions and competitive factors.

Stop Losing Revenue to Unpaid Units

Discover how leading operators are cutting delinquency rates by up to 80% while saving hours of staff time every month.

Continue Reading