From Cost Center to Profit Driver: Reframing Your Approach to Delinquency Management

The Traditional View: Delinquency as a Necessary Evil

For most self-storage operators, delinquency management has traditionally been viewed as a cost of doing business—an unavoidable drain on resources that delivers little value beyond mitigating losses.

It's easy to see why. The conventional delinquency process is:

Labor-intensive: Staff spend hours tracking payment status, sending notices, and managing auctions

Error-prone: Manual processes leave room for compliance mistakes that create legal exposure

Reactive: Most operators only address delinquency after it becomes a problem

This perspective has led many operators to underinvest in their delinquency processes, treating it purely as an operational cost to be minimized rather than optimized.

But what if this view is fundamentally flawed?

The Financial Reality of Delinquency Management

To understand the true financial impact of delinquency management, let's look at a typical mid-sized self-storage operation with 100 units:

Traditional Approach Costs:

Staff time: 15 hours/month at $25/hour = $375/month

Legal consultation: $200/month

Mailing and administrative costs: $150/month

Average monthly revenue lost to prolonged delinquency: $1,200

Total monthly cost: $1,925

These numbers might seem manageable, but they scale dramatically with your portfolio. For operators with multiple locations, the financial impact can easily reach six figures annually.

Shifting the Paradigm: Delinquency Management as Revenue Recovery

Forward-thinking operators are now approaching delinquency not as a cost center but as a revenue recovery engine.

This requires a fundamental shift in mindset:

The Revenue Recovery Model in Action

When delinquency management is viewed through a revenue recovery lens, the financial picture changes dramatically.

Here's how the numbers shift when implementing an automated, strategic approach:

Revenue Recovery Approach:

Reduction in delinquent units by 40% through early intervention

Faster resolution of remaining delinquencies (avg. 22 days faster)

Reduction in staff time by 80% (down to 3 hours/month)

More efficient auction process with higher recovery rates

Reduced legal exposure through compliance automation

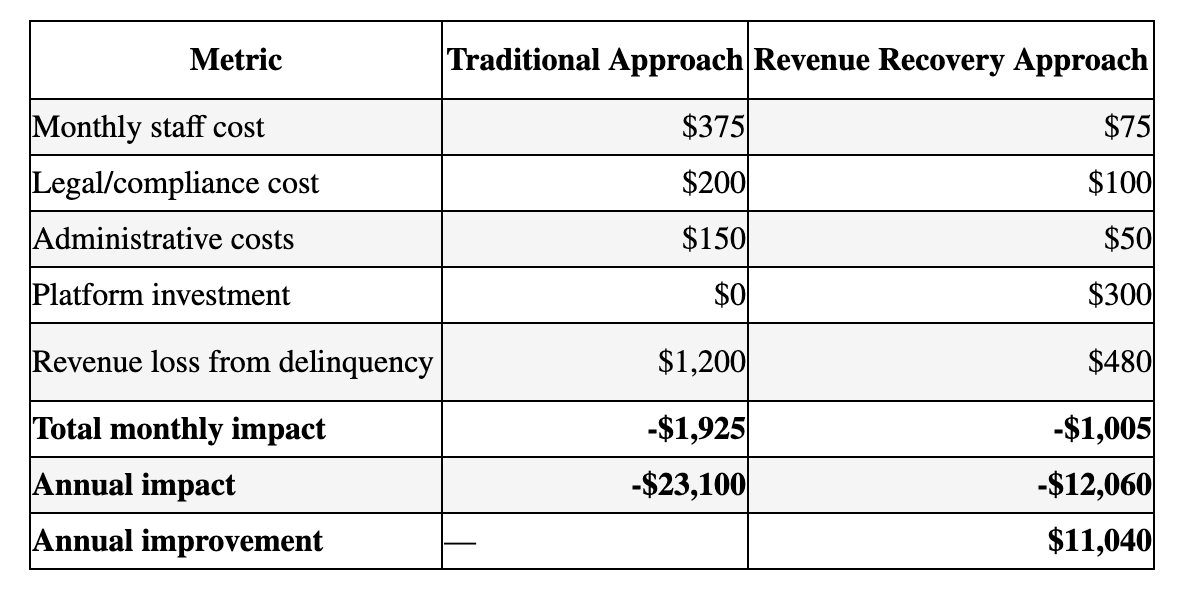

Financial Model Comparison

Here's how this plays out financially for our example 100-unit facility:

Note: This model doesn't even factor in the opportunity cost of having units unavailable for new rentals due to prolonged delinquency.

Industry Results

Operators using automation platforms like Ai Lean have reduced bad debt by 50% and cut over-90-day delinquencies by up to 95%.

Storage Star, after implementing a revenue recovery approach, reduced delinquency to under 2% and dropped bad accounts receivable from $1M to $120K in just 90 days, saving hundreds of staff hours monthly.

Online auction platforms such as StorageTreasures report average lien loss recovery rates of 39%, with some operators achieving up to 71% recovery by following best practices and leveraging automation.

Industry case studies show that integrating automated payment management, proactive communication, and remote management can reduce accounts receivable by up to 88% and increase monthly revenue by $16,000.

Real-World Success: Storage Star's Transformation

Storage Star implemented a revenue recovery approach to delinquency and saw dramatic improvements in both operational efficiency and financial performance:

"Ai Lean helped Storage Star reduce delinquency to under 2%, a major improvement. In one region, bad accounts receivable dropped from $1M to $120K in just 90 days." — District Manager, Storage Star

The results speak for themselves:

80% reduction in delinquency rates

70% less time spent on auction tasks

500+ hours saved monthly across the company

Faster unit turnover leading to increased revenue

The Technology Enabling This Shift

The transformation from cost center to profit driver is made possible through automation technology that:

Detects issues early: Identifies payment patterns that predict delinquency before it happens

Accelerates communications: Automates the sending of notices via multiple channels

Ensures compliance: Manages state-specific requirements without manual intervention

Streamlines auctions: Reduces the time and effort required to recapture revenue

Provides analytics: Offers insights for continuous improvement of recovery rates

Getting Started: Reframing Your Approach

To begin shifting your delinquency management from cost center to profit driver:

Audit your current process: Calculate the true cost of your delinquency management, including labor, lost revenue, and opportunity costs

Set recovery targets: Establish clear metrics for improvement in recovery rates and timelines

Invest in automation: Implement technology designed specifically for self-storage delinquency management

Analyze the results: Track your ROI and continue optimizing your approach

Conclusion: A Strategic Imperative

In today's competitive self-storage market, operators can no longer afford to view delinquency management as merely a cost of doing business.

By reframing it as a revenue recovery function and investing accordingly, you can transform what was once a financial drain into a significant profit driver.

The question isn't whether you can afford to make this shift—it's whether you can afford not to.

Interested in learning how Ai Lean can help transform your delinquency management from cost center to profit driver?

Schedule a demo to see our platform in action.

References

XPS Solutions

Navigating Tenant Delinquent Payments in Self-Storage. Published: March 4, 2025Modern Storage Media Rupp, Ciera.

Late Again: Managing Chronically Delinquent TenantsTrepp

CMBS Research - Self-Storage Sector Delinquency Report

Published: October 2020

Continue Reading